One out of three customers believe phone calls are the most secure form of communication with their banks and financial institutions. Even as the financial services industry experiences rapid digital transformation, it’s clear that customers prefer talking with a real human when it comes to their finances and large purchase decisions.

So, rather than seeing phone calls as a hindrance or drain on time and resources, how can financial service marketers both serve their clients and take advantage of the influx of calls?

The solution is to deploy a real-time business communications and analytics platform that can analyze data from phone calls to better understand which marketing channels and materials drive those calls while also enabling you to take action from those insights. In turn, financial institutions can then leverage this data to boost their marketing return on investment (ROI) and out-market their competitors.

Here are four ways that a business communication and analytics platform like CallRail can help you level up your financial service marketing campaigns.

Call tracking numbers reveal highest converting marketing channels

Unique call tracking numbers are the foundation of all call tracking software. When different phone numbers are assigned to each of your marketing channels — such as your website, landing pages, paid ads, Google My Business page, and other online channels — you’ll know the exact call source for all incoming calls.

The clearest benefit of using call tracking numbers is simple: the data you collect paints a picture of your highest and lowest performing digital marketing channels, enabling you to choose where to allocate your marketing budget to lower your cost per lead (CPL) and boost your ROI.

For example, let’s say your financial business allocated $3,000 for a Facebook click-to-call ad campaign. However, as your phone starts ringing and you ask potential leads how they found your business, a majority of callers indicate they found your business after going to your website through a Google search.

Without call tracking, you would have to wait until the end of your ad campaign before you could measure your results. However, when you deploy unique call tracking numbers to individual channels (such as your Facebook Ads and your website ), you would see real-time data on which channels drive the most traffic at any given time.

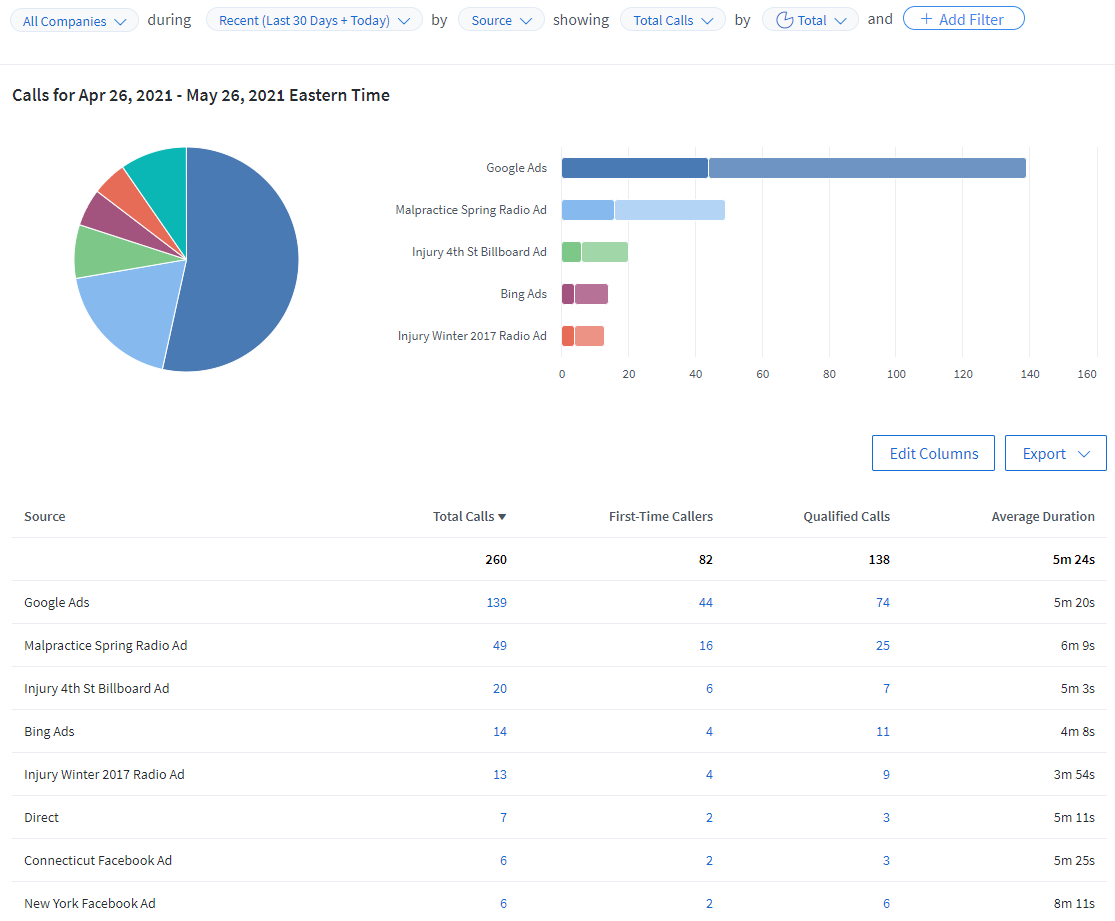

Caption: See exactly where your calls are coming from with CallRail’s Call Attribution Report. Source: Call Attribution Report

To better help businesses visualize exactly which channels are driving results, CallRail’s Call Attribution Report highlights:

- Sources of calls

- Total calls received per source

- First-time callers

- Qualified callers

- Average duration of calls per source

The more information you glean from which marketing channels drive phone calls, the easier it is to fine-tune your marketing.

Conversation Intelligence helps you create hyper-focused marketing materials and fine-tune your ad budget and spend

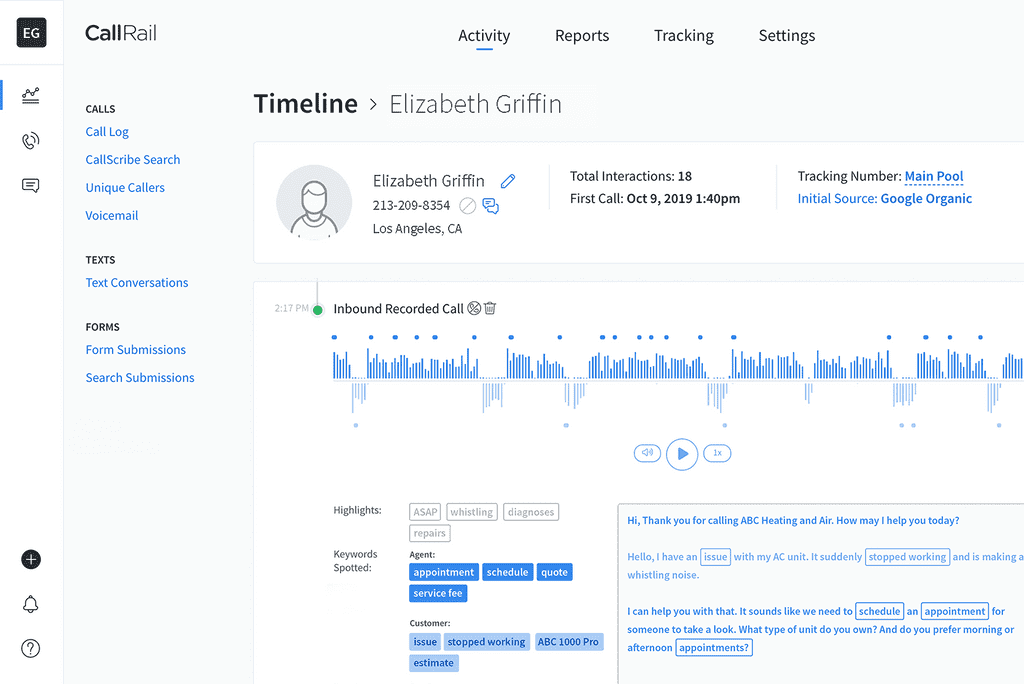

When Call Recording is enabled in Call Tracking, Conversation Intelligence harnesses the power of AI to automatically record, transcribe, and analyze each of your inbound phone calls.

Conversation Intelligence’s Call Highlights feature automatically identifies and highlights the most frequently-said words and phrases from your customers, then synthesizes that information so you can better understand the context and content of each conversation.

Depending on the types of financial services your business provides, you may find that most of your customers call about “mortgages,” “refinancing,” “loans,” or “financial plans.”

Additionally, you can choose specific keywords for Conversation Intelligence to highlight with Automation Rules. This is especially helpful in instances where you may want to monitor specific keywords and conversations to better understand the origin or quality of leads.

For example, if your business uses Facebook ads, Conversation Intelligence can highlight each conversation containing the term “Facebook” to help you more accurately attribute your inbound calls to your ad campaigns. Or you can choose to only be notified of keyword mentions from those callers who actually clicked on your Facebook ads.

Caption: Discover the content, context, and keywords of each of your inbound calls with Conversation Intelligence. Source: CallRail’s Conversation Intelligence

Each frequently-spoken keyword and phrase surfaced by Conversation Intelligence holds tremendous potential for your marketing efforts. When you know what your potential leads and clients commonly talk about, you can improve your PPC keyword bidding strategy to better reflect the search intent of your potential customers. You can also optimize your content and marketing material to directly address those specific topics and keywords

This optimized content might look like:

- Blog posts focused on specific customer pain points and topics that come up over and over again

- Social media posts that answer commonly asked questions about your financial services

- Ebooks and other downloadable materials that provide detailed walkthroughs of financial scenarios your customers experience

- Talking points for online webinars or financial health seminars

With Conversation Intelligence, you no longer have to guess what content will engage your visitors and leads; you’ll have data directly drawn from leads’ conversations with your sales and customer service teams. Likewise, you can use these insights to better train your sales and customer support staff to deliver seamless customer experiences from start to finish.

Form Tracking shows you how users arrive at your website and marketing materials

Similar to call tracking, CallRail’s Form Tracking uses the same technology to track website visitors through the customer journey before submitting a web form. With the same snippet of java code used by our Call Tracking solution, you can use new and existing web forms to:

- See which keywords a visitor used to find your website;

- Which ads they clicked, and;

- Which pages of your website they’ve visited.

All this data is then compiled into a timeline for each lead, giving you a detailed overview of how they found your site and the information they found helpful.

On a micro level, understanding how a lead interacts with your website and marketing material lets you determine where they are in the customer journey and follow up with targeted sales messaging. And on a macro level, the insights you gain from Form Tracking help you identify areas in your sales funnel you can optimize to accelerate the purchase process.

For instance, if a visitor Googles “retirement planning,” clicks on your landing page, and fills out a form, you’ll know the context that led to the form submission. You can then follow up with relevant sales messaging and materials..

Source: CallRail’s Form Attribution

Plus, with the Form Attribution Report, you can see which marketing channels and interactions are most responsible for driving traffic and generating form submissions on your site.

Lead Center organizes all calls, texts, form submissions, and live chats in a single inbox

Regardless of the channel they use, one-third of customers expect a response to their question or inquiry within an hour. The longer they have to wait before hearing back from you, the less likely they are to convert into a paying client. Additionally, these customers want to communicate with you using a channel (or channels) they’re most comfortable with.

CallRail’s Lead Center is a unified business communication solution that uses a single inbox to organize and display a timeline of every call, text, web form, and live chat you’ve had with each of your customers and leads. Combined with a built-in soft-phone feature and instant notifications when your business is contacted from any channel, you can quickly improve your lead response time and reduce the chance of an opportunity falling through the cracks.

Caption: Keep all your lead and customer communication organized in a single inbox with Lead Center.

Let’s say a lead finds your financial service through a pay-per-click (PPC) Facebook ad, and they complete a web form on your website. Lead Center captures that data and marks the form as unread, flagging you and your customer service team for a quick follow-up on the phone.

When your team contacts the lead via phone call, Call Tracking and Conversation Intelligence work together to record, analyze, and store the call data and transcript within Lead Center. Now, you and your service team can revisit both the call transcript and any future communication touch-points with the client without having to comb through multiple communication channels and platforms.

Combined with softphone functionality, call routing, and the ability to use warm and cold transfers between agents, Lead Center is a powerhouse business communications solution that gives your financial business the edge in communication.

Improve your marketing with CallRail

The more insight you have into how your leads and clients think and feel, the easier it is to create high-converting marketing campaigns and provide a strong customer experience. And in today’s fiercely competitive financial industry, how well you capitalize on this insight could spell the difference between a successful financial business and an unsuccessful one.

Rather than rely on blanket-marketing tactics, use CallRail to better understand your clients, hone your marketing message to attract more leads, and provide stronger customer experiences that set you apart from the competition.