With an expected growth of $13.9 billion by 2025 and the number of users regularly using mobile payments and online banking options increasing, digital banks and financial services are on the brink of incredible growth.

But only if they attract these new, digital customers to their services before the competition does.

As individuals from every age bracket turn to digital banking for their financial needs, it is only by implementing digital and multichannel marketing strategies that financial institutions can capture larger portions of the market share.

What is multichannel marketing?

Multichannel marketing is the practice of building strong relationships with new and existing customers over various marketing channels and mediums, such as social media, blog posts, email, podcasts, pay-per-click (PPC) ads, etc. By being present in multiple channels, a brand or business can create multiple touchpoints for customers, meeting them on their preferred channel with the right message at the right time.

A tax consultant, for example, could use a blend of content marketing, PPC ads, and local radio broadcasting to promote a special tax-season discount on their tax filing services. A mortgage loan officer could combine direct mail and social media to reach customers in a certain geographic location, encouraging them to call a trackable phone number to learn more about a special APR rate for select customers.

This multichannel approach allows financial service providers to build greater brand awareness while also reaching customers who rely on different media channels for information. Additionally, it works to keep providers top-of-mind as customers switch between channels multiple times per day.

Check out these five high-performing channels that you can mix and match for your financial services marketing campaigns.

5 most effective channels for financial services marketing

Social media

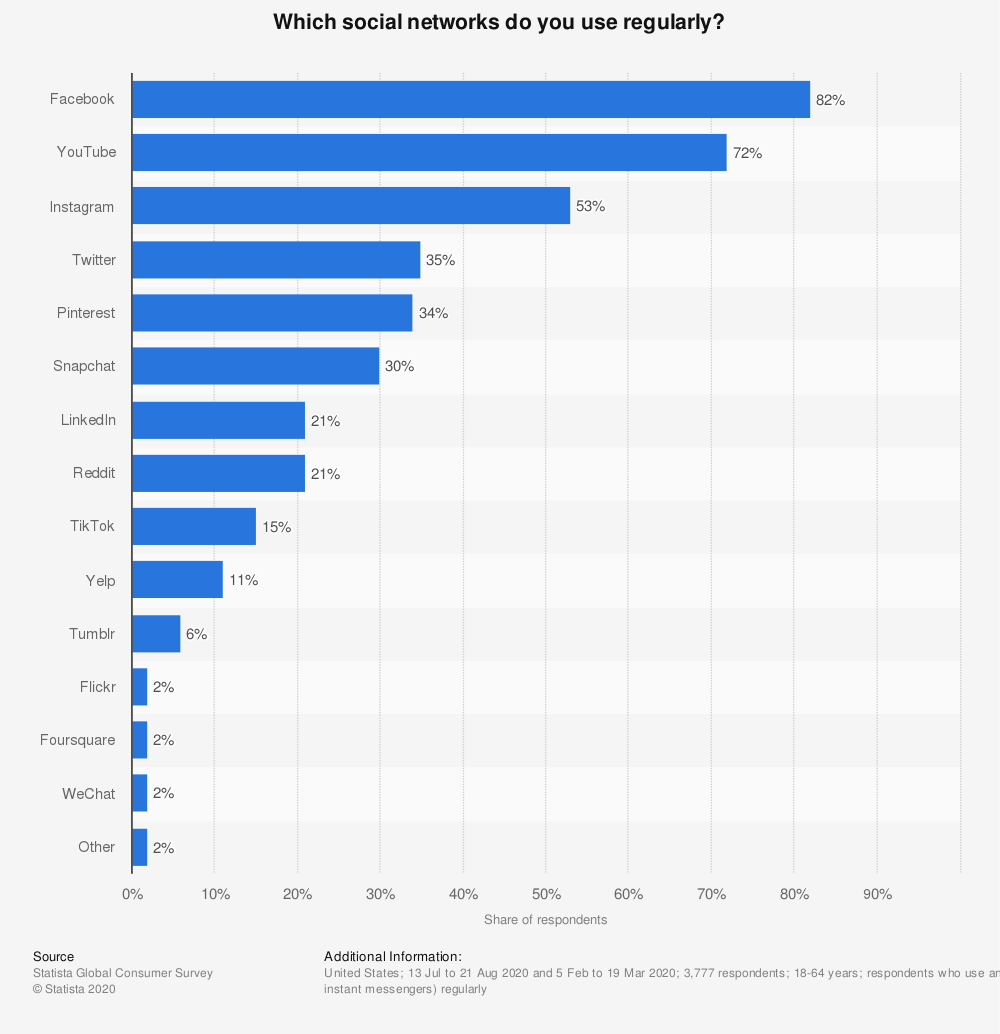

Social media platforms present the greatest opportunities for your financial services marketing campaigns, with Facebook, YouTube, and Instagram ranking as the most popular social media channels in the U.S.

With 72.3% of the U.S. population spending an average of 127 minutes per day browsing social media, these channels make it easy to build rapport and trust with large audiences quickly.

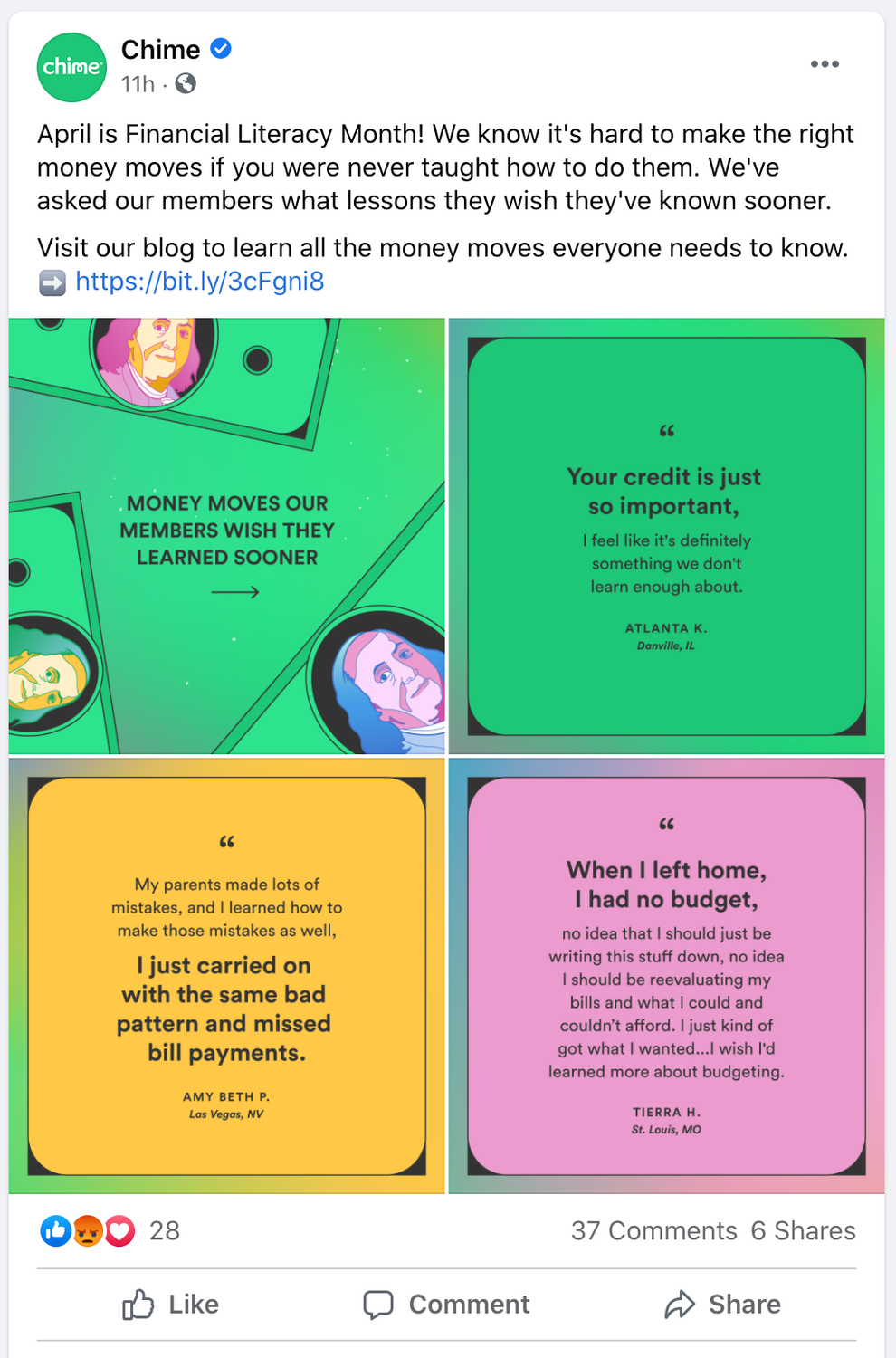

Chime, an online-only bank, uses Facebook to promote content that helps its followers better understand and manage money.

Here, Chime provides its followers with a link to a blog post featuring fellow bank members talking about money habits they wish they had learned in school. This blog post does away with fancy financial jargon and banking terms. Instead, it serves as part case study and part promotion — providing real stories from people who are improving their financial health using Chime’s online financial services.

Related: Learn more about how you can use Facebook for your financial service business

Multichannel Pro Tip: Social media works best with a solid content marketing strategy (more on that below). People will get tired of your posts and unsubscribe if you only post about another promotion or sale, so mix it up and post fun, helpful content that educates readers and piques their interest in your company as a whole.

Pay-per-click advertising

Pay-per-click (PPC) advertising allows you to quickly place your financial services, products, and offers in front of audiences. Google Ads and Facebook Ads are the two largest ad platforms on the internet. Both use a keyword bidding format that allows advertisers to set how much they’re willing to pay to show up higher or more frequently on search pages and social media feeds.

As the name suggests, however, this channel does have a cost. PPC ads for financial services on Google Ads average $3.44 per click, while similar ads on Facebook average $3.77 per click.

The reason is that both platforms let users directly target specific audiences. With targeted PPC ads, you can make sure that only those who fit your targeted audience receive your ads, and you only pay when someone clicks them.

A credit union may only want to offer a new account incentive to people in a specific geographic area. Or a retirement advisor might target individuals specifically searching for the keyword “retirement account.”

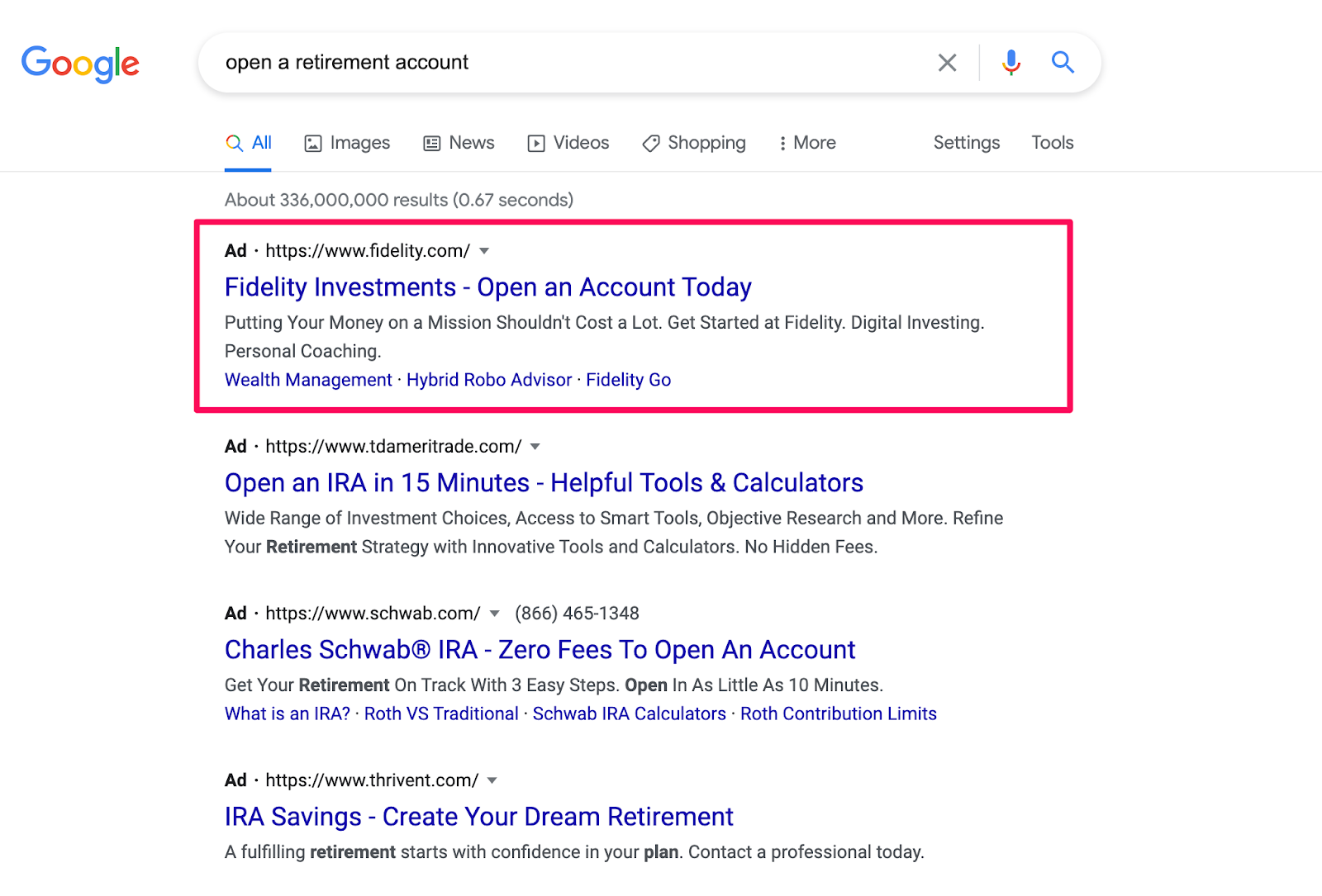

Fidelity Investments is a prime example of the latter. They use both Google and Facebook ads to promote their retirement and financial planning services.

When someone searches “How to open a retirement account” on Google, Fidelity’s PPC ad is the first listing on the page — providing viewers with a clear pathway to their website.

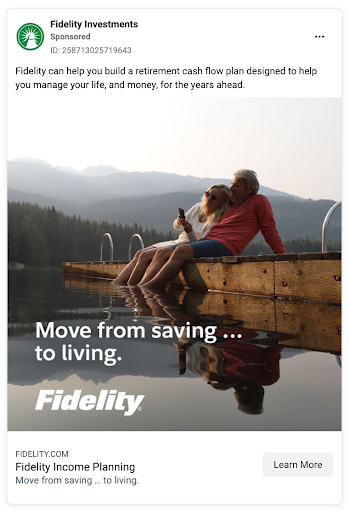

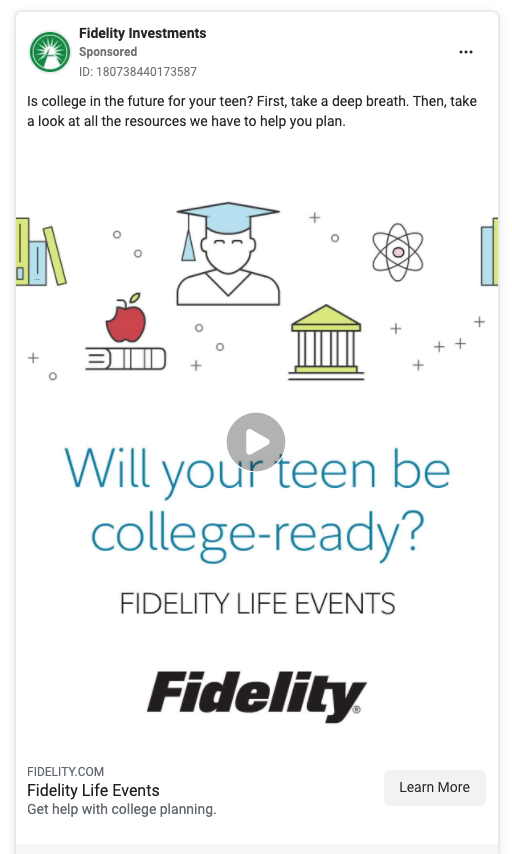

On Facebook, Fidelity serves their targeted ads to different age demographics, using imagery and different messaging to best connect with their viewers.

In the first instance, the ad targets middle-agers and seniors looking for retirement help. The second ad is targeted toward parents looking to save money for their teen’s college education.

Multichannel Pro Tip: PPC ads rarely result in massive conversions the first time around. Even the most laser-focused ads will need to be tested and tweaked before consistent results start coming in. To speed up the process, create two or three variations of an ad — changing the headline, picture, and body copy — to see which ones convert the best. Choose that ad and rerun the test.

Click to learn more about PPC marketing or learn how to supercharge your ad performance using call tracking with your PPC ads.

Search engine optimization

With 53% of web traffic coming from organic (unpaid) searches, search engine optimization (SEO) is a critical marketing channel for every financial institution to reach customers online. If you can’t find your website on Google, you’ll constantly struggle to find new clients for your business.

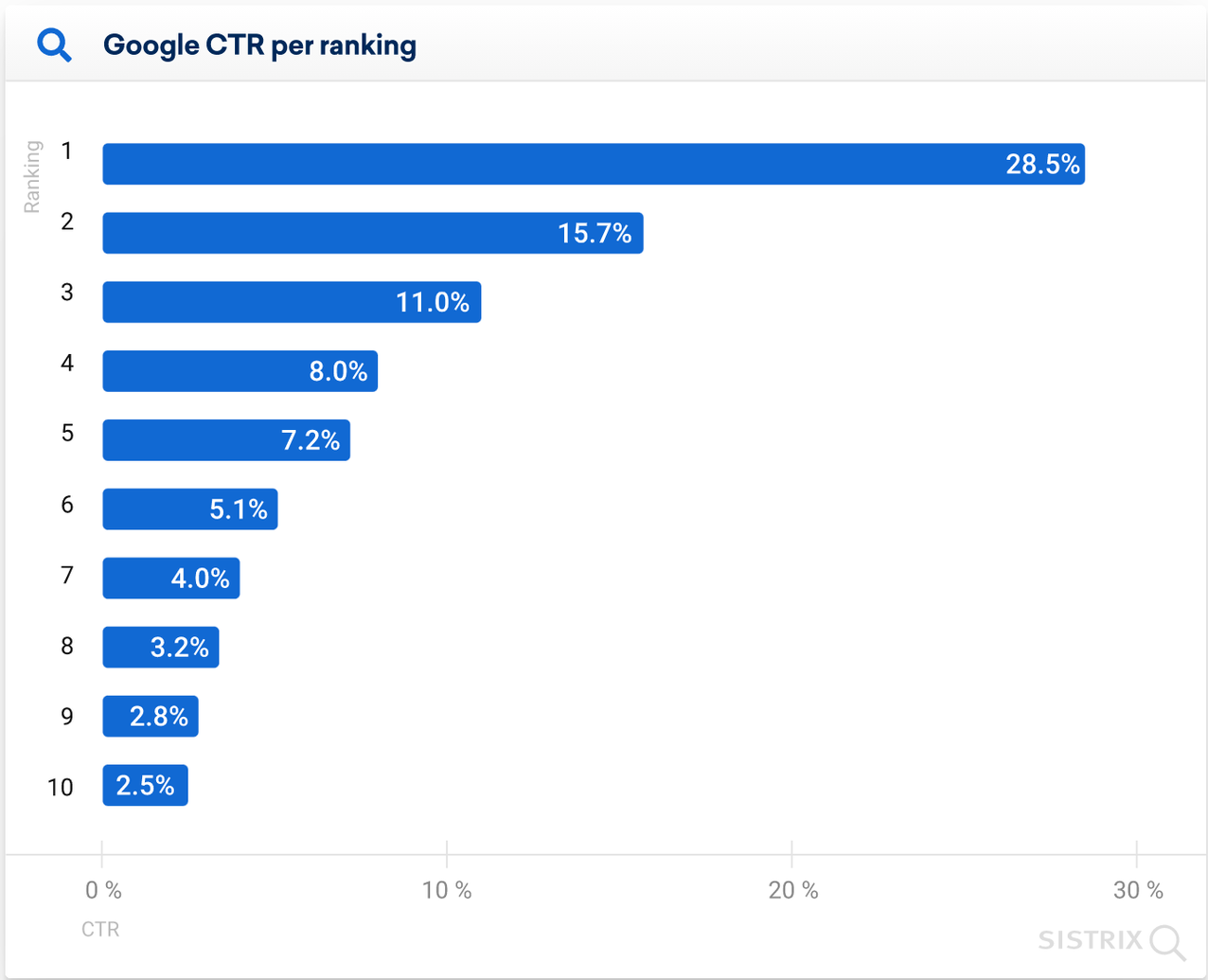

The higher you can rank in search engine result pages (SERP), the better. A study conducted by Sistrix showed that listings in the first spot of organic traffic receive 28.5% of clicks, while listings in the tenth place only receive 2.5% of clicks.

Google uses a complex search algorithm to determine your SERP ranking, but you can help Google better understand your website and increase your chances of ranking higher. A couple of factors include:

- Backlinks: How many other credible websites point back to your website

- Quality Content: How helpful your content and how well it satisfies the reason why searchers came to your website in the first place

- Topical Authority: How well your website covers topics. The more in-depth, helpful content on your website, the greater your chances of ranking higher.

- Page loading speed: How quickly your page loads on desktop and mobile devices

- Mobile-friendliness: How easy it is for users to access and use your website on smartphones, tablets, and other smart devices

- Website security: How secure your website is for users

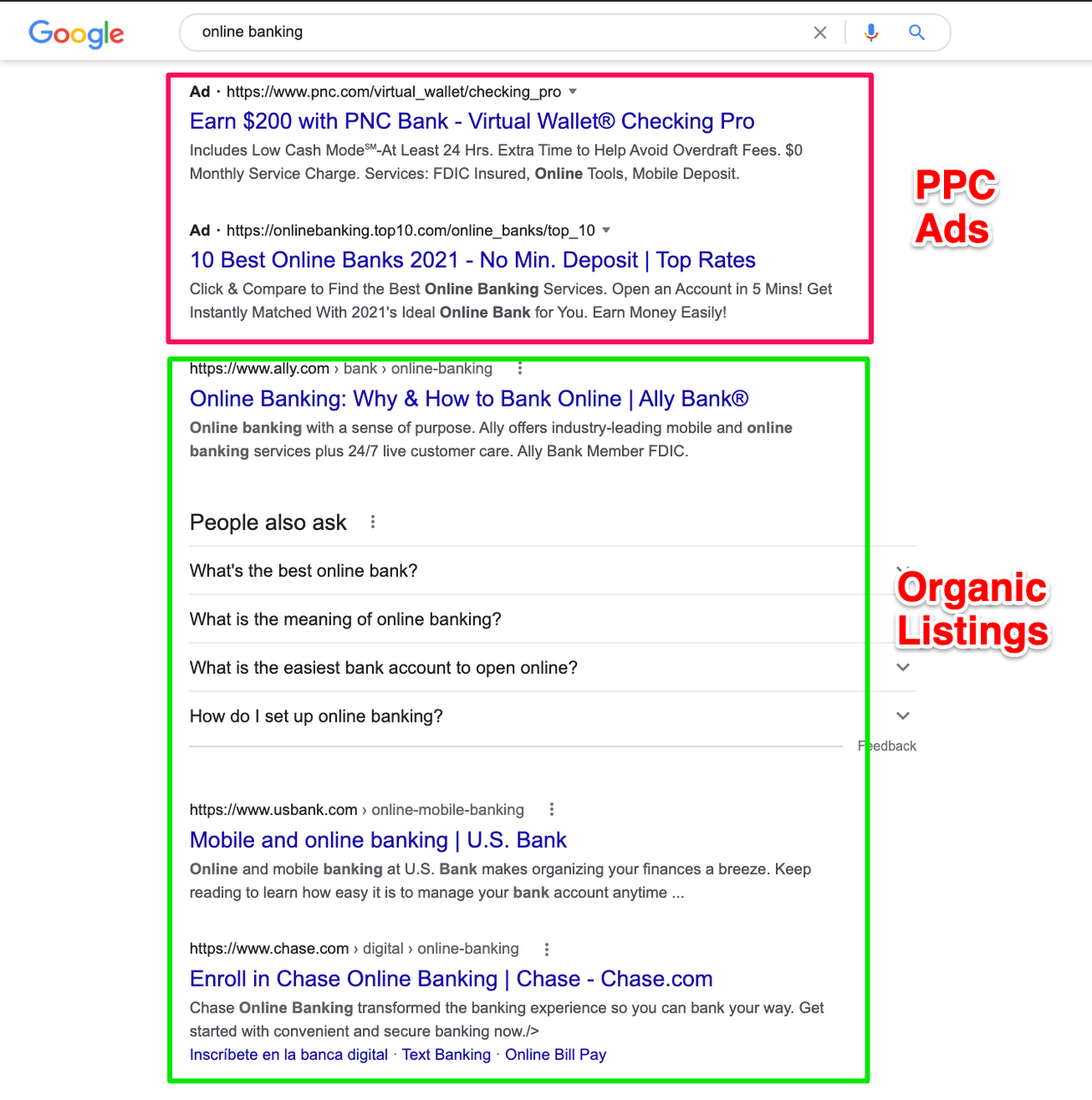

An individual searching for “online banking” in Google might find this as their search engine result:

While the top two results are ads, the next three are organic listings that use SEO to grab the top spots on the SERP. At the time of this search (rankings can change daily), Ally Bank has held the top spot, promoting their “industry-leading mobile and online banking services plus 24/7 live customer care.”

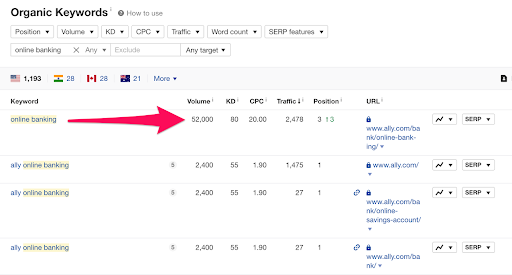

A deeper dive into their rankings shows even with stiff competition for the keyword “online banking,” their first position ranking brings upward of 52,000 clicks per month!

Multichannel Pro Tip: Not sure which keywords you should be targeting for your SEO marketing strategy? Take a look at your competitors to see what they’re ranking for! Competitive analysis tools like Ahrefs, Semrush, and Spyfu allow you to input any website address to see which keywords they’re ranking for. Take these keywords and see if there are any gaps you can fill with your own keywords.

Content marketing

A strong content marketing strategy can boost your performance on search engines while also providing you an opportunity to connect with visitors on a practical and human level.

In the previous example, we saw an individual do a direct search for “online banking.” But what if someone has a specific question about debt relief? Or what if they’re looking for information on different types of savings accounts? Content marketing answers these questions with helpful content in the form of blog posts, webinars, social media posts, podcasts, videos, and other forms of media. The purpose of content is to build trust between customers and your financial service.

Quicken Loans — a leading mortgage lender — uses various content types to attract new customers to their business.

Their online Learning Center is full of blog posts, mortgage calculators, case studies, and tips for individuals wanting to learn more about mortgage loans.

Additionally, they’ve used YouTube, Apple Podcasts, Facebook, and Instagram to create and distribute valuable content that appeals to a variety of viewers. By spreading their content out on multiple platforms, Quicken Loans can reach customers on their preferred channels. One customer, for example, might enjoy watching an informative video during a lunch break, while another might prefer listening to a podcast as they run errands.

Multichannel Pro Tip: It might be tempting to create content on every medium imaginable, but the best way to approach content marketing is to focus on one or two mediums at a time. Research which mediums your audience spends most of their time on, then be there.

Email marketing

Email marketing can be one of the most effective channels for financial services marketing. Even with the rise of texting and other messaging platforms, email usage continues to grow. There were 4 billion email users worldwide in 2020, and that number is projected to reach 4.6 billion by 2025.

Email also has one of the highest return on investment rates of any marketing channel, averaging $42 for every $1 spent.

Email can help keep your financial service business top-of-mind for customers and drive awareness of financial offers and/or products when used in tandem with content marketing and social media.

H&R Block uses email to promote their tax-filing services and provide subscribers with reminders of important tax dates — keeping their business top-of-mind when tax season rolls around.

Source: H&R Block

Source: H&R Block

This email uses eye-catching colors and benefit-driven copy to show that H&R Block is there to help with all of a subscriber’s tax needs. It also contains links to H&R Block’s social media accounts, along with a phone number to call if the recipient has any questions.

Multichannel Pro Tip: Use trackable contact forms on your website to gather email addresses to communicate with subscribers consistently. These forms will help you see where your traffic originated from, helping you understand which of your marketing channels contribute to higher conversions.

Spread out your financial services marketing to meet more customers

Simply focusing on a single marketing channel to drive brand awareness and sales for your bank or financial business won’t cut it anymore. Your customers are everywhere online, and the financial service that engages with them through various media channels will stand head and shoulders above the rest. Take an inventory of your current marketing efforts, identify marketing areas that could be fused to be more effective, then implement your new multichannel approach to reap the rewards.